Our Compass

Context

Past year or so has been mentally taxing for Web3 investors big and small. Speculation in its purest form has taken over the market, having participants second-guessing the outcome and questioning own beliefs and motivations. “Meaningless” on-chain sh*tcoins keep getting most of the attention and retail volume, while “VC coins” are struggling to keep their high launch pricing and gain much volume.

While we hold off our personal judgement as to which of the two categories has more real value, the cynical view of everything as vaporware is the prevailing bias – and hence “pure” vaporware like celebrity coins is getting bid up more willingly then obfuscated vaporware of blockchain infra and the like.

Thus, industry insiders are grappling with what’s right or wrong in business where the only quantifiable measure of effectiveness is the amount of money being made. On the retail side the on average indebtedness of those from the developed world and lack of sustainable opportunities for those in the over-populated emerging countries are driving people more towards lottery-ticket style investments. One simply cannot afford to spend years saving and acquiring wealth when attention can be turned into quick riches and the reference for “making it” for both cohorts is the flex culture of the young and rich on social media.

What’s Behind It

We are at the tail-end of a big monetary expansion cycle. Financial markets are exuberant and moral hazard is universal. This coincides with the secular uptrend in digital-native technologies like Blockchain and AI, which complicates things by confusing the observers. I.e. Web3 and AI would’ve outperformed any other sector regardless of the conditions, but because current late phase of the financial cycle is, as typical, characterized by increased participation from unsophisticated investors, this uptrend is punctuated by reflexive bubbles along the way.

Narrative around crypto has constantly been hijacked by get-rich schemers, but this time the veneer of innovation is completely ripped off in favor of most straightforward pump-and-dump schemes, also suggestive of latest stages of financial bubble characterized by financial nihilism. Thus, celebrity and 4chan meme coins and real blockchain applications are conflated as equally representative of the industry, which irritates both insiders and outsiders, while hijacking most of the attention and retail flow.

The real culprit is not human nature, which has always been the same, but liquidity, a.k.a. financial wealth, penetrating any vessel – whether a dying brick-and-mortar video game retailer or a digital token representing an internet meme permissionlessly created on a blockchain. But financial wealth does not equal real wealth and its convertibility into the latter will always get tested. But until it happens en masse financial wealth effect will dictate how people feel and act. While the market may not feel as crazy yet and the overall liquidity conditions compared to peak euphoria are still modest, we are in an unusually financialized environment with anyone bidding their two cents on whatever gives them hope.

As mentioned above, people, especially younger generations, feel inferior and poor (even though the average standard of living globally has never been higher) and their only perceived opportunity is some get-rich-quick scheme. They are too low on savings and patience for anything else. This culture trickles down into our industry, leveraging its permissionless markets to mix with loose financial liquidity of the past few years and create this cocktail of real greed and fake vibes. The market is almost forced to drink it now, which unfortunately ends up only in a heavy hangover.

How does one ride this trend without getting caught up in taking on too much unnecessary risk and moral baggage? It is hard to withstand social pressure, but we’d like to offer our mental model and derive from it a navigational Compass that helps us find guidance in what is playing out as the most mentally-taxing cycle in crypto, coinciding with a bigger financial and global power cycle.

Historical Perspective (the Mental Model)

Our industry cannot be seen in a vacuum. It is easy to forget when deep “in the trenches” that the world around us is also experiencing traumatic change expressed through social tensions, wars and larger than usual generational divide even within families.

While only a few of us have time or attention span to read books these days, reading the relevant ones is very important. Positioning oneself in a historical and socio-economic context to understand the day-to-day in the bigger picture is crucial for investors. Thankfully there are just two books one must read to understand “the crypto play” in this perspective: The Changing World Order by Ray Dalio and The Sovereign Individual by James Dale Davidson and William Rees-Mogg1. Both are lengthy but reading into 25-30% of each is enough to get the gist.

Here are their main respective points that we overlap to derive a model of the current historic moment:

- Humanity leaps with roughly 500-year-old cycles of socio-economic development based on power dynamics. The last half-a-millennia was a cycle of the Big Secular State rising in terms of power and influence, which was preceded by roughly as long of a period of dominance of the Church (in the West). We are on the cusp of a new change brought about by the power shift from the State to the Individual thanks to the technological breakthroughs in microchip computing. What it implies is armies and territories the states currently control become less relevant in determining power dynamics in the digital space of the near future, which becomes the main economic arena. With power monopolies over portions of the digital space effectively impossible, individuals get to operate anyhow and anywhere they want in this environment without depending on the state for being able to access such opportunities. This is the Sovereign Individual thesis in a nutshell.

- Over the course of the last 500 years, which coincides with the Big State rising, a succession of empires that had dominated the world economy for roughly 100-year periods occurred. The leading empire of its era becomes the global economic and financial center and its currency - the world’s reserve currency. That last element, in turn, inevitably leads to weakening of the dominant empire’s economic output over time (together with other factors like rising cost of labor and mounting complacency), since exporting its currency to the rest of the world implies running a budget deficit in exchange for goods and services from others, which makes it bankrupt over time if something doesn’t give. So, while acquiring a global reserve status for its currency is a goal of any state engaged in the global trade, it also contains the seeds for its eventual demise.

- Usually, the loss of global reserve status happens over a succession of events that make the currency less attractive for other states and economic players to hold their wealth in (e.g. Covid-induced printing of dollars quickly followed by the action to freeze Russia’s USD reserves within the same 12-month time frame may have been the first act). Re-pricing of the currency is what allows the by-then indebted empire to relief it’s burden and get back on track to adding productivity. The Dutch, the British and currently the U.S. have all undergone such cycles with their respective currencies dominating the world trade as reserve means of exchange and store-holds of wealth.

- United States is currently in decline as the most recent global empire which has implications for the dollar-denominated assets in the near future, as well as its economic and social structure. China, on the other hand, is the new global empire on the rise, striving for economic, military and financial dominance. This leads to a conflict that typically resolves in new empire establishing its power globally at the expense of the old empire.

This is the Changing World Order thesis in a nutshell.

Now, if one trusts the data, logical arguments and understanding of the human nature both books brilliantly display and takes their respective theses as a given, we may combine them to arrive at the mental model of today.

Specifically, we agree that the U.S. empire is in decline, which will lead to a re-pricing of all USD-denominated assets and significant changes in the country’s internal order and global external order. The Chinese empire may be on the rise as well, but we believe that it may face competition that is not a different empire, but the whole paradigm altogether: the internet has spawned subcultures and closed-loop digital economies (e.g. blockchains) that are more real to their participants than their physical surroundings.

With the proliferation of network states and other forms of jurisdictional arbitrage, we expect the trend of detaching oneself from the culture of one’s place of origin to grow. While it’s hard to say whether self-sovereignty is a universally desired state for everyone, it is definitely clear that the number of individuals opting out for such form of self-organization will get significantly higher. The rise of such “self-sovereigns” is precisely the product of the global interconnectedness (the internet), leveraged for the proliferation of digital asset and identity ownership systems (blockchains) and economic actor systems (AI agents).

Is Future Pre-determined?

However, we also believe that there is a chance that the Big State may continue to grow in power over individuals globally and the pushback to the model of complete government control with total digital surveillance may not be strong enough. China has already been exporting its policies subvertly via surveillance tech and is more aligned on this with states like e.g. EU than most people notice, so the shift to the total state control even in countries originally considered as individual-friendly is already underway and very much tied to the digital transformation, rather than hindered by it. China’s rise as the dominant global economic power will only speed it up.

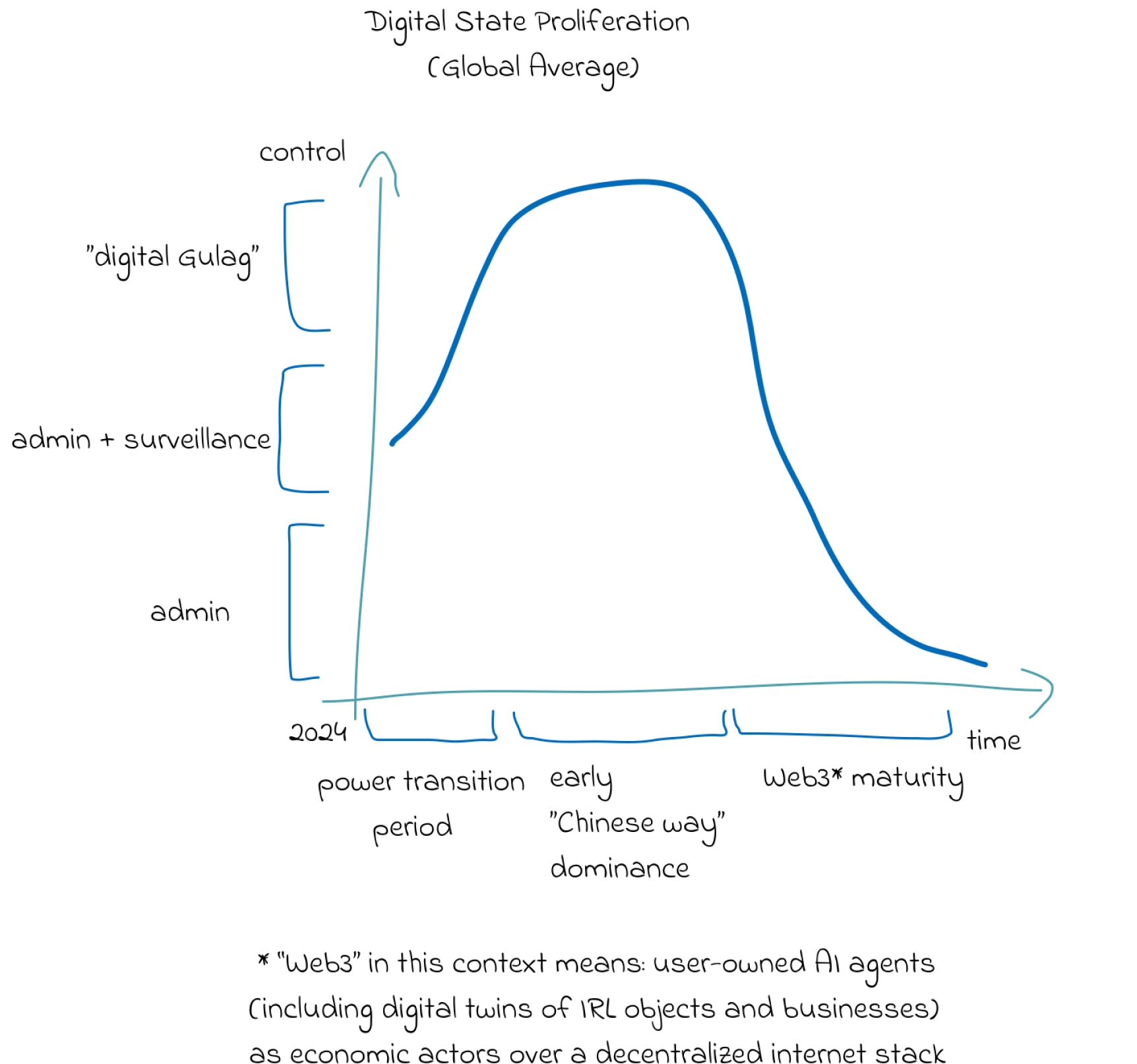

We also expect the Chinese way of using AI – i.e. simple, but effective tools for managing big data-heavy applications like train scheduling, traffic management and maintenance of civic infrastructure – to penetrate government services globally with other technological exports (even if by copying, since actual imports are currently restricted in the West). China will be the first major country to start cutting down on its bureaucratic apparatus in favor of AI- and robotics-powered administrative functions while citing fight with corruption and inefficiency as its goal, and such approach will probably echo across other jurisdictions. We’ve already seen how united even opposing governments are in the face of common threats (e.g. COVID-19 restrictions): wouldn’t be surprised to see the same model - applying AI to portions of government functions - incorporated elsewhere in various forms and under modified pretexts.

So, by responding to the public’s clear lowering of trust, the governments will implement the technological solutions that over time may help shrink their functions to purely administrative. However, we don’t expect this shift to happen fast and expect the more immediate effect to look more like “digital Gulag” (i.e. total control – not just surveillance but automated repercussions for any deviations), before any real progress. While smaller sovereignties, special economic zones or other forms of “network states” for the more privileged may implement a digitally-automated minimized government much sooner, creating an arbitrage.

Rising levels of state digital surveillance may also create a bigger opening for censorship resistant and privacy preserving tech, which are currently mere buzzwords with users picking better UX over anything. As the divisive political forces between the "East" and the "West" keep prevailing, with users getting banned from services based on their physical presence or origin, more and more people will look into Web3 alternatives even if the experience is still inferior. With that being said, it is our duty as an industry to ensure that the UX is as seamless as possible and has no chokepoints by then.

The graph may look something like this: digital surveillance and control rise to some dystopian level in the bigger states until jurisdictional arbitrage and development of censorship-resistant tech force it to eventually get diminished to admin-only function.

So, while the rise of China with its proliferation of AI-driven automation across industries and verticals will export this trend to other states, eventually shrinking the government’s role in the longer run, in the shorter timeframe it also creates political tensions and more fragmentation for global internet services.

The combination of both factors is essentially a big tailwind for the Web3 vision, but this scenario is not a given. The alternative world where the Big State or corporations become even bigger with the help of technology is very much a possibility. The real outcome is determined in the technological realm. The party that has the most cutting-edge technology to produce most economic output in the digital world, whether it’s the CCP, the Hyperscalers or the free and decentralized Web, will determine the outcome.

This uncertainty leads us to derive our Compass (a guiding set of expectations, which determine the investment principles we adhere to) for the next few years in business until the "Web3 Maturity" phase in the chart above.

Our Compass

Important belief that underlies our strategy is the conviction that long term investments will survive the tectonic shifts in global power dynamics and socio-economic fabric. Just as the markets survived WW2 which precipitated a new global financial system and ultra powerful technologies of atomic bomb and first computers. Yet very few of investors and builders will exit this turbulent period unscathed. One must accept it and look for ways to survive and prevail, rather than expect the world to “solve itself”.

As the power-struggle grows into bigger open conflicts between rivaling world powers – whether trade and technology wars, supply chain blockades or direct physical clashes, it is important to us that we have well-functioning decentralization on all layers of the Web3 stacksince any dependency on centralized systems will get tested and most likely exploited. It means that even the lowest level technology like networking and data transfer protocols need to be censorship-resistant and decentralized enough to withstand any state-level attacks/bans etc. Same applies to middleware for hosting the frontends as well as blockchain and off-chain node infrastructure running in the cloud. Protocols and applications able to maintain their global reach as the world transitions through a fragmentation phase will become category-winners in their respective layers of the stack.

We also expect there to be a meaningful repricing of all assets, goods and services relative to fiat currencies and primarily US dollar. Specifically, we see fiat currencies becoming drastically cheaper and assets more expensive in fiat terms. Such a repricing is never gradual, so we are preparing for a sharp decline (even 20-30% is sharp for a reserve currency) over a series of exchange rate adjustments. Only meaningful value accrual can beat high inflation levels on an adjusted basis.

As the fiat financial system experiences more stress tests, it is important for investors and builders to be able to keep doing our jobs under a heightened pressure from the regulators (remember – private ownership of gold was first prohibited in the 1930s in the U.S. as the government had to re-peg the dollar to this hard currency. Bitcoin is a new form of hard currency for the digital age, in our view). Financial sanctions, trade and market-access bans, regional firewalls and proliferation of state digital warfare will inevitably make technology front and center of the global tug-of-war during power transition. One needs to find most neutral jurisdictions to operate from and ensure falling under compliance regime that is most optimal for innovation.

Innovation is the most important part of the mix here. While within-category competition has been driving a lot of private market deployment so far, we don’t believe in category second/third movers unless their execution is flawless. Hence, we have preference for projects creating their own categories through genuine innovation because in the environment we are anticipating in the next 10 years only the outliers will drive superior inflation-adjusted returns.

Getting caught up in “momentum plays” that derive their strength from liquidity conditions and market exuberance, described earlier in this essay, is also a risk we are trying to avoid. While there are definitely gains to be made across multiple categories targeting speculative environment, we try to not get caught with our pants down when it is time to run for the fences. It is very hard to time markets, especially with long-term investments, so we just try to adhere to a simple rule of avoiding investments targeting current trends or based on extrapolation of the past successes into the future.

So, we make it our mission to:

- Support genuine innovation

- Seek and push our portfolio companies towards true decentralization

- Ensure optimal regulation regime for ourselves and portfolio companies

- Not engage in momentum and speculation-driven investments

None of these principles is based on our high moral grounding or sense of righteousness, but only a pragmatic view of the world as we described above. We hope such an evaluation of the historical moment resonates with more of our peers and builders we support, as it is truly upon us to shape the future and there is no time for slacking and chasing deceptive benchmarks of the passing fiat regime.

Footnotes

- To go beyond these two for a deeper psychological analysis along the same theme (especially for the US as the dominating country for financial markets), our full list would also include: The Alchemy of Finance by George Soros and The 4th Turning by Neil Howe and William Strauss in combination with Generations by Jean M. Twenge. ↩